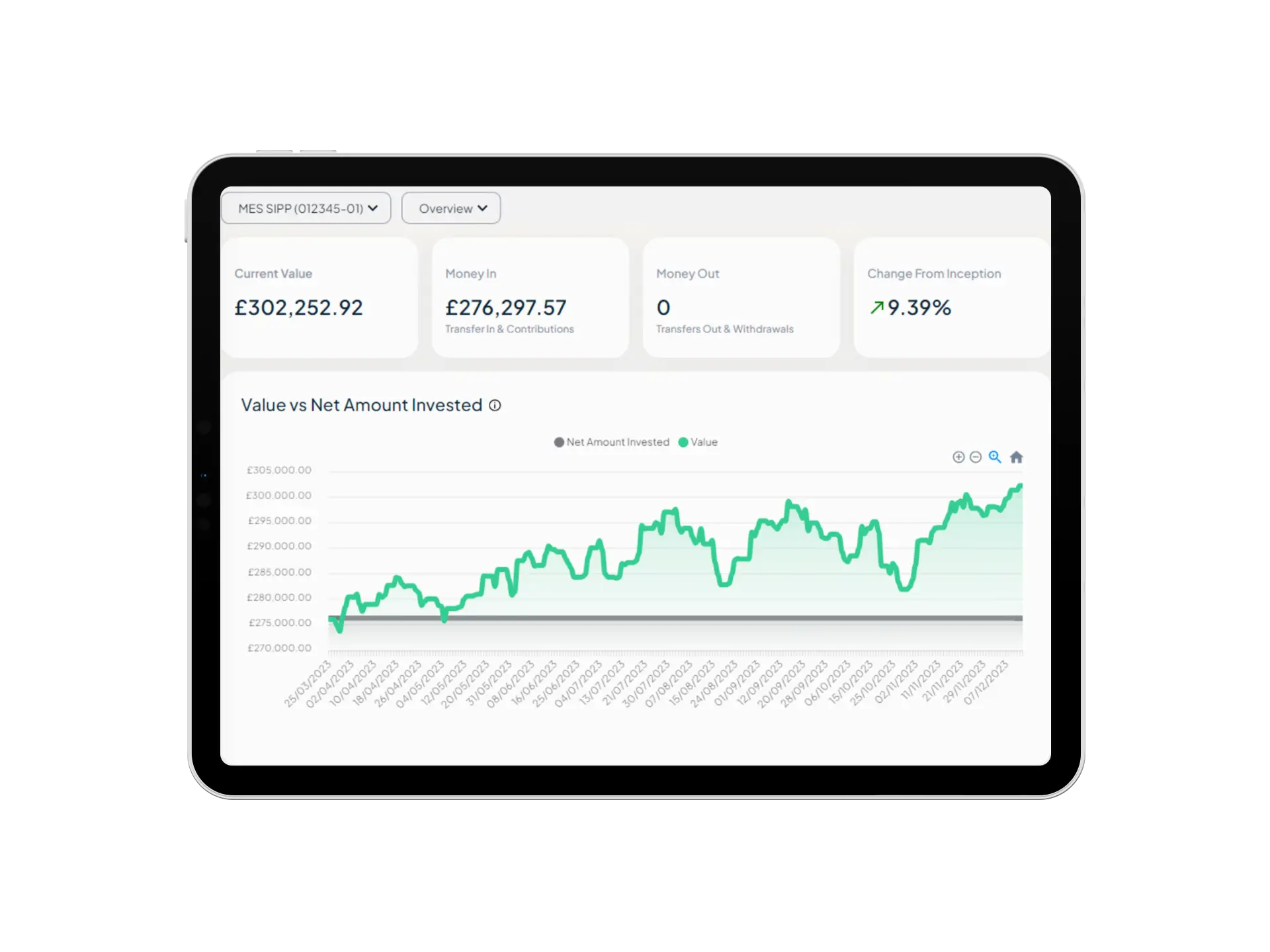

Welcome to MyExpatSIPP

The SIPP built for expats and non-UK residents

Making it easy for expats and non-residents to manage their pension in the UK.

FCA authorised & regulated

No adviser required

For expats & non-residents

Putting you in control of your UK pension

The MyExpatSIPP service enables expats and non-UK residents to stay in control of their UK pension and investments from anywhere in the world, without having to use a Financial Adviser.

Transfer a single pension or combine multiple pensions into the easy to manage online SIPP account with complete control over how your pension is invested, together with full support and guidance from our pension experts.

You get full access to your pension from age 55. Keep your pension invested and take withdrawals whenever you want via flexi-access drawdown. You can take lump sums, a regular income, a combination or nothing at all. Withdrawals can even be paid to a non-UK bank account.

Our platform allows you to choose how your money is invested and you can select from:

- Exchange Traded Funds

- Investment Trusts

- Unit Trusts & OEICs (Mutual Funds)

- A range of ready-made options

Your pension, in your currency

You can choose the base currency for your account, the currency of your investments and even the currency of your pension payments.

Support when you need it

We have expert knowledge to assist you with managing your pension in the UK and will explain the options available to you and the implications of being resident overseas.

Wide range of investment options

We offer thousands of Exchange Traded Funds, Investment Trusts, OEICs and Unit Trusts from the world’s leading investment managers in multiple currencies.