International SIPP (Self Invested Personal Pension)

Take control of your pension with our easy to manage, online International SIPP.

What is a SIPP?

A Self-Invested Personal Pension, or SIPP, is a type of UK registered pension plan that provides you with a greater amount of control and flexibility over the money in your pension. You get to decide how it’s invested, and from age 55 onwards (age 57 from April 2028), you get access to 100% of your pension and decide how much and how often to withdraw.

Why MyExpatSIPP?

Our service is designed for expats, whether you’re a non-UK resident or living in the UK. Monitor your account around the clock and place investment instructions with the easy to use online account, alongside ongoing support and guidance to assist you with managing your pension. Our simple and transparent fees mean there’s no hidden commission or ongoing adviser fees.

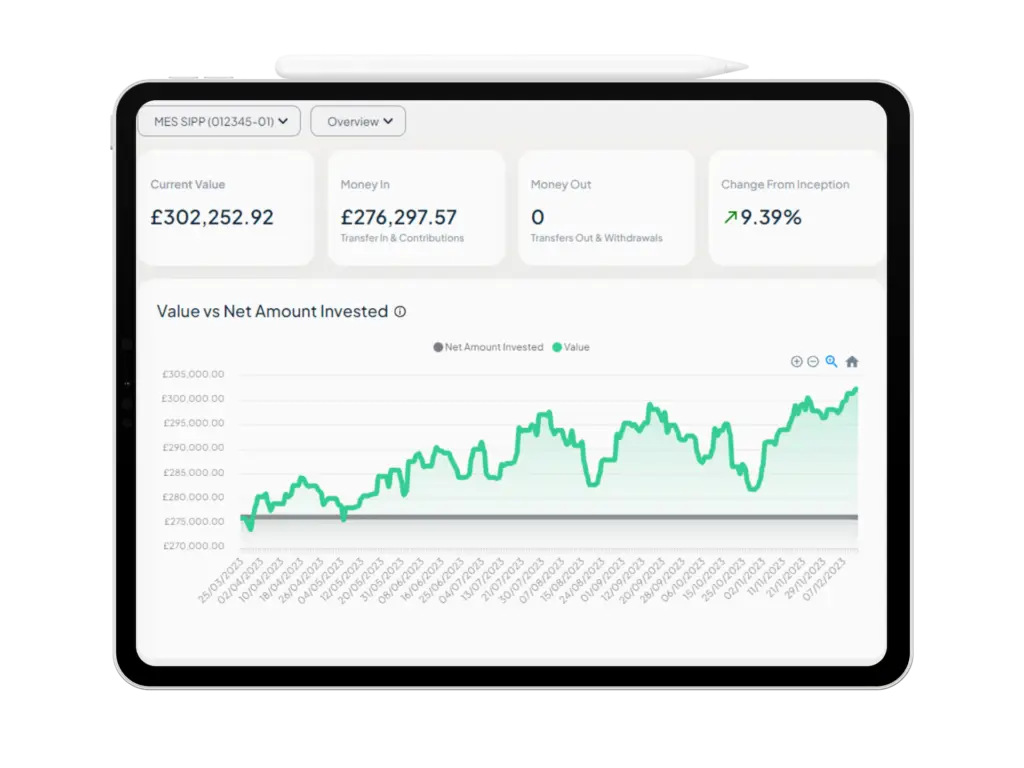

Keep track of your pension from anywhere

Our service is tailored for individuals who are no longer resident in the UK or are likely to move overseas in the future. We have expert knowledge to assist you with managing your pension in the UK and will explain the withdrawal options available to you and the implications of being resident overseas.

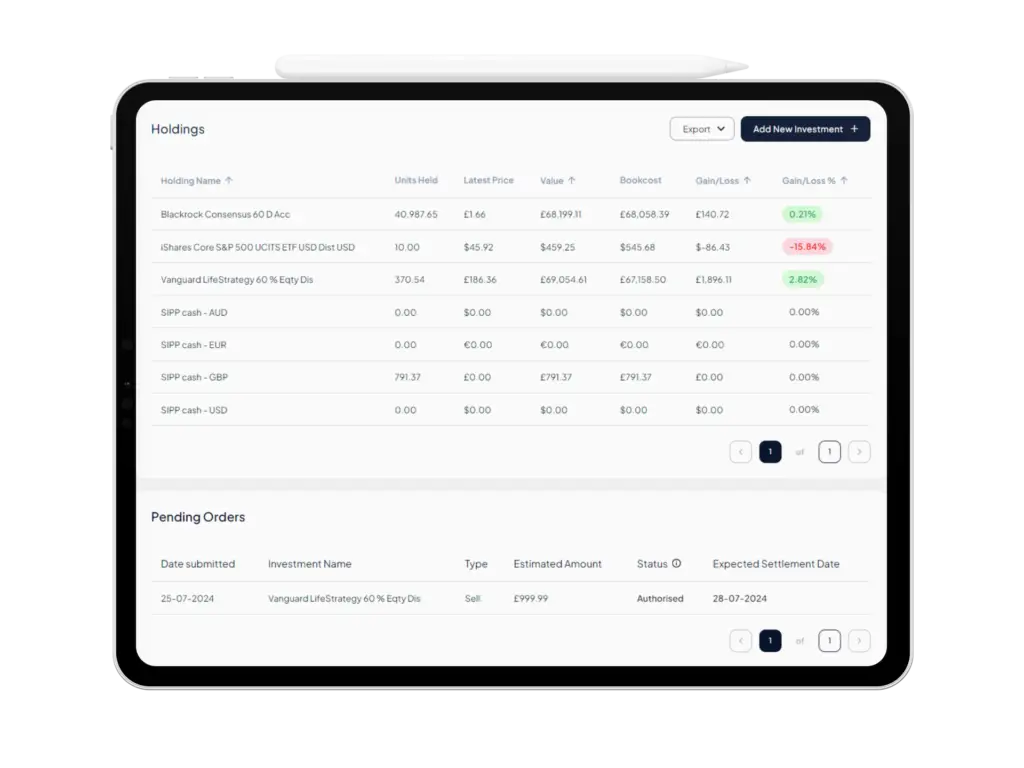

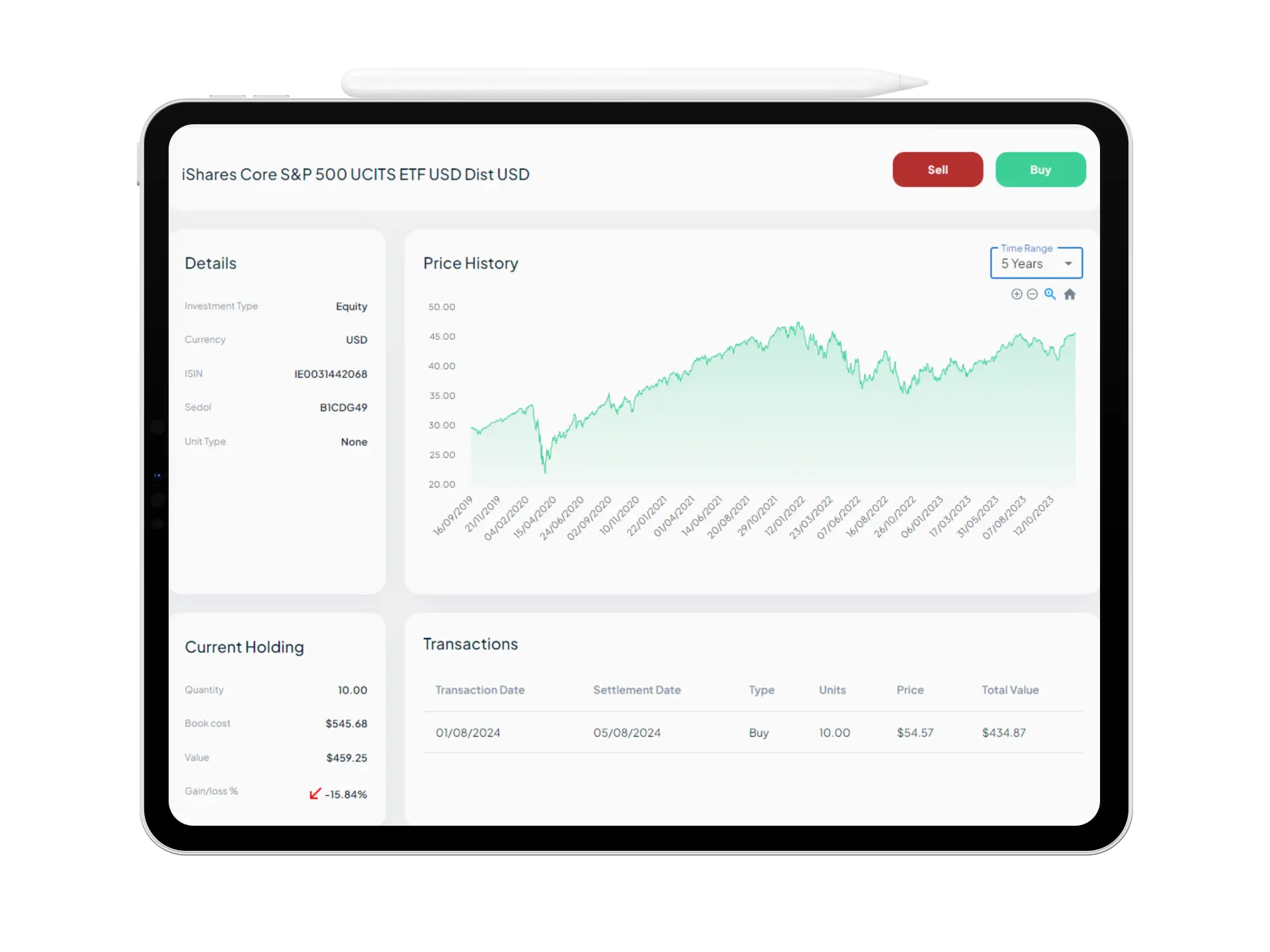

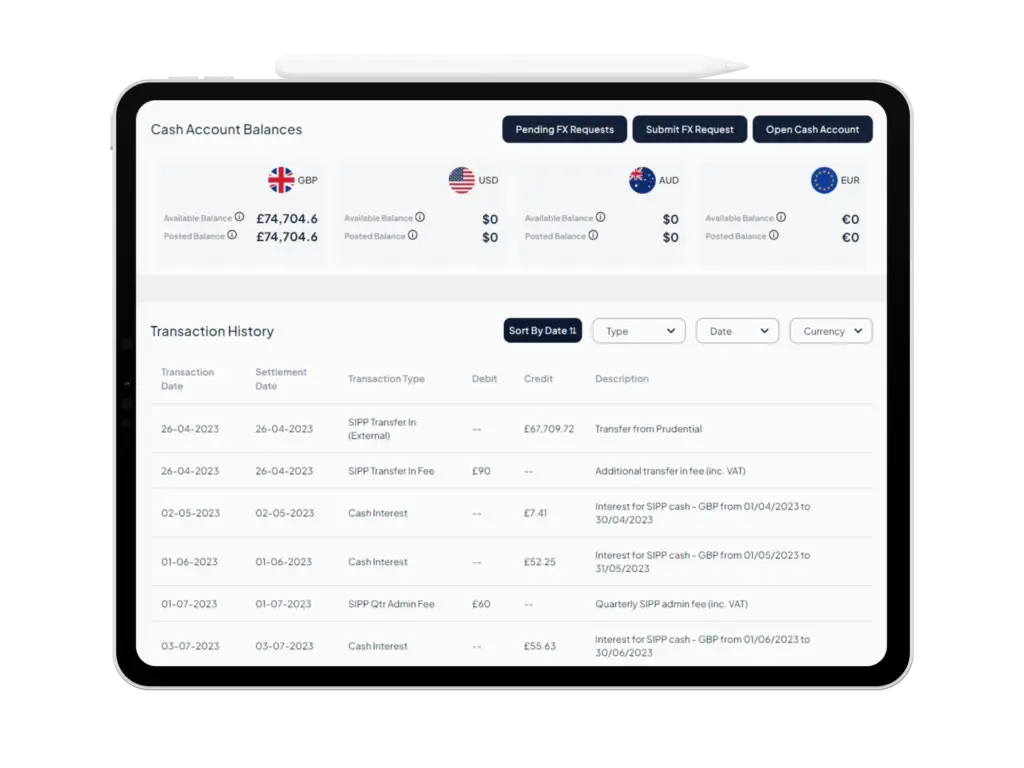

Monitor your investments

There’s no need to wait around for statement from an old adviser or pension provider. You can see full details of the investments in your SIPP so you can easily see up to date performance.

Investment Control

The MES SIPP allows you to build a portfolio of investments that is tailored to your preferences. There’s a wide choice of investments from the world’s leading investment managers. Choose from thousands of Exchange Traded Funds, Investment Trusts, Unit Trusts and OEICs.

The lower cost MES Essentials SIPP has a single investment option of the Vanguard ActiveLife Climate Aware 60-70% Equity Fund

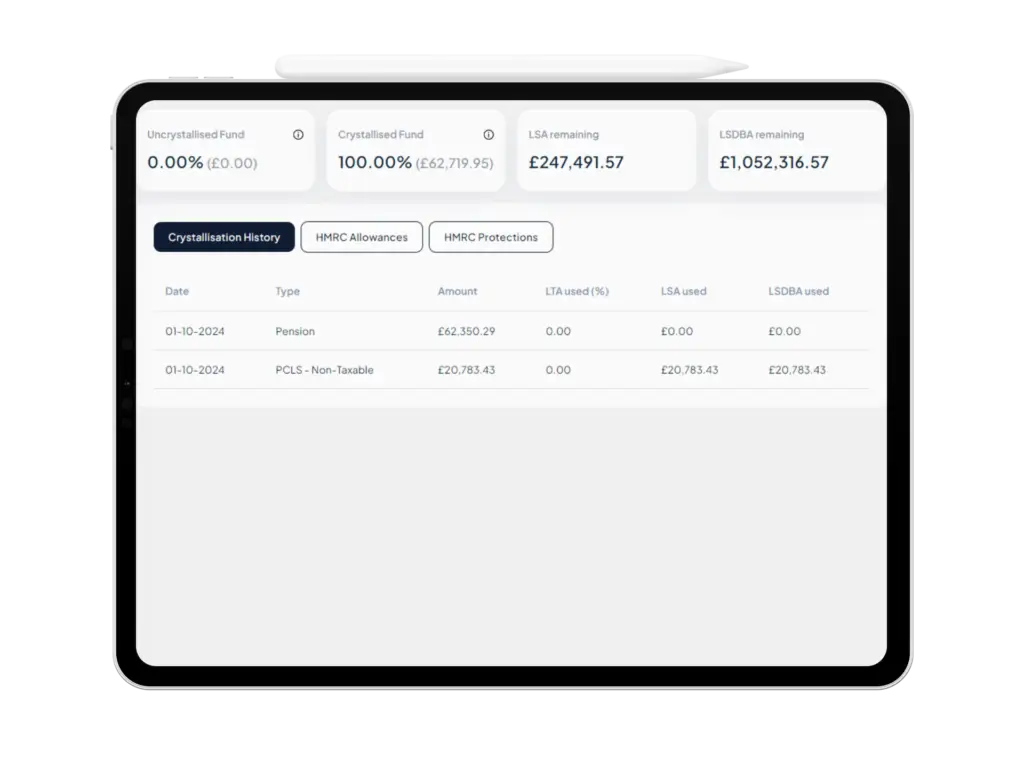

Full access to your funds

Easily access your funds when you need them* with flexible withdrawal options, enabling you to adapt your retirement income to your changing lifestyle and financial needs.

*in the UK the minimum pension age is currently 55, rising to 57 from 2028.

Withdrawals paid in US Dollars Australian Dollars Canadian Dollars Euros Pound Sterling South African Rand New Zealand Dollars UAE Dirham over 40 currencies

Enjoy the convenience of receiving your pension withdrawals in the currency of your choice, reducing the impact of currency exchange rates and giving you more control over your finances.

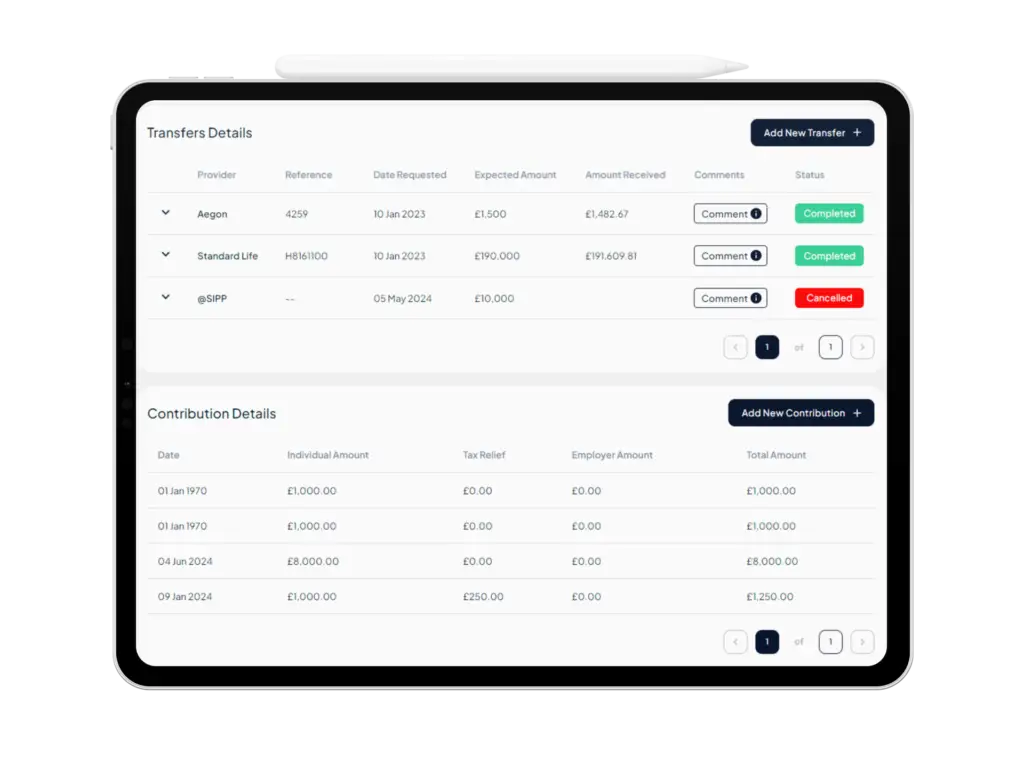

Easy to transfer

You don’t need to waste time completing lots of paperwork, just add the transfer online and we’ll do the rest. We’ll keep you updated with progress and let you know once money arrives. MES is part of the Origo Transfer Service meaning some transfers can be completed in a matter of days rather than weeks or months.

SIPP Fees

One of our founding principles is to keep the charges for your pension simple, fair and transparent. We don’t believe in taking hidden commission or confusing charges from your account. When others make it difficult to know exactly what you’re paying, we make it simple and easy to understand so you know exactly where you stand.

Our charges includes full support and guidance from our team to help you manage your pension and investments, as well as arranging the safe custody and administration of investments on our platform.

We offer two SIPP products: The MES Essentials SIPP is a simple, low cost option. The MES SIPP is designed for investors who require the wider investment choice.

MES Essentials SIPP

Annual fees: £360 + 0.3% p.a.

From £35,000

Full flexi-access drawdown

Payments to overseas bank accounts in over 40 currencies

Default investment option only (Vanguard ActiveLife Climate Aware 60-70% Equity Fund)

MES SIPP

Annual fees: £435 + 0.35% up to £1m, 0.2% over £1m

From £50,000

Full flexi-access drawdown

Payments to overseas bank accounts in over 40 currencies

Multi currency cash and investments

Online dealing in Shares, ETFs, Investment Trusts, Unit Trusts, OEICs

How to transfer your pension to the SIPP

Transferring a pension to your new SIPP account couldn’t be easier, we’ve made the process as simple and as paperless as possible. We will keep you up to date with the progress of the transfer so you can get on with more important tasks.

1.

You complete the simple online application to open a SIPP account which includes details of your existing pensions.

2.

We contact your existing pension provider(s) and instruct them to transfer the pension to your new SIPP account.

3.

The money is paid into your new SIPP account and invested into your chosen investments.

Frequently Asked Questions about the SIPP

If you can’t find the answer you’re looking for, please send us a message

Eligibility

Yes, we can accept applications from residents of most countries, although there may be some countries that we cannot accept. We will let you know if this is the case.

In the application, you must provide us with your National Insurance Number (NINO). This is your individual UK tax identification number and consists of two letters, six numbers then a letter e.g. AB123456C.

You must be aged 18 or over to open a SIPP account with MyExpatSIPP.

Transferring a pension

We are a member of the Origo Transfer Service which means we can transfer the majority of UK pensions without you having to complete reams of paperwork.

When you set up your SIPP account, we’ll ask you to enter the details of the pension you want to transfer, such as the name of provider, your policy number and approximate value. If the existing provider is a member of Origo, we will instruct the transfer via Origo and you usually won’t be required to do anything else. We’ll liaise directly with your existing provider to arrange the transfer and will let you know once it is complete. Transfers via Origo can be completed in just a few days although generally it takes 2-3 weeks.

If they’re not a member of Origo, your existing provider will have a transfer discharge form that will need to be completed by yourself and us.

Yes, the SIPP is ideal for combining multiple pensions into one easy to manage online plan. When you sign up you can include multiple pensions and we will transfer all of these into your new plan.

When transferring a pension containing safeguarded benefits, such as a Final Salary pension, with a transfer value of £30,000 or more, you must obtain appropriate independent advice from an FCA authorised and regulated Financial Adviser. As we do not provide financial advice, you will need to arrange this advice separately. You can find a register of advisers on the Government’s Money Advice Service website.

Once you have obtained this advice and have the confirmation of advice certificate, we can assist you with transferring to the SIPP.

Yes, we have helped many people who have previously transferred their pensions to an often expensive and unnecessary QROPS. In most instances, you will be able to transfer your money from the QROPS into our SIPP, but it will depend on who your QROPS is with. Contact us and we can let you know if it’s possible.

If you have been awarded a percentage of your ex Spouse’s pension as part of a pension sharing order, you will be able to transfer this to a new SIPP with us. Get in touch and we’ll let you know how to arrange this.

Making contributions

Yes. However, in order to obtain UK tax relief at source, you must be classed as a relevant UK individual. If you’re not classed as a relevant UK individual you can still contribute to your SIPP, but you will not be able to obtain tax relief on your contribution.

You are a relevant UK individual for a given tax year if you:

- have relevant UK earnings chargeable to income tax for that tax year; or

- are resident in the United Kingdom at some time during that tax year; or

- were resident in the UK at some time during the five tax years immediately before the tax year in question and were also resident in the UK when you joined the pension plan; or

- you or your spouse have, for that tax year, general earnings from overseas Crown employment subject to UK tax (as defined by section 28 of the Income Tax (Earnings and Pensions) Act 2003 (ITEPA).

If you fall within category b), c) or d) above and you do not have relevant UK earnings, the maximum member contribution is the basic amount (currently £3,600 including tax relief).

As a general rule, most income that is earned and assessable for income tax in the UK counts as relevant UK earnings.

Income that generally does NOT count includes:

- Pension income.

- Dividends.

- Most property rental income.

- The first £30,000 of a redundancy payment.

- Income earned in the UK but not subject to UK income tax due to a double taxation agreement with another country where you are liable for tax.

Examples of earnings that count as relevant UK earnings can be found on the HMRC website here: https://www.gov.uk/hmrc-internal-manuals/pensions-tax-manual/ptm044100#earnings.

A summary of some types of relevant earnings is provided below:

- Employment income such as salary, wages, bonus, overtime and commission providing it is chargeable to tax under Section 7 (2) Income Tax (Earnings and Pensions) Act 2003 (ITEPA).

- Income derived from the carrying on or exercise of a trade, profession or vocation (whether individually or as a partner acting personally in a partnership) chargeable under Part 2 Income Tax (Trading and Other Income) Act 2005.

- Rental income is generally not relevant earnings. Some rental income may be included if it relates to UK or EEA furnished holiday lettings under Part 3 of Income Tax (Trading and Other Income) Act 2005 (ITTOIA 2005).

- Patent income, where the individual alone or jointly devised the invention for which the patent in question is granted, but only if it falls under specific tax categories.

- General earnings from an overseas Crown employment which are subject to tax in accordance with section 28 of ITEPA 2003.

The above is not a complete list of relevant earnings. If you are in any doubt as to whether earnings, on which you are reliant to justify the amount of contribution being paid, are relevant UK earnings, then you should seek professional advice.

Yes. It must be a limited company that is registered in England & Wales. Contributions from the company are usually allowed as a business expense.

Taking withdrawals

Under UK pension rules, you are allowed to start taking withdrawals from your pension once you reach Normal Minimum Pension Age (NMPA) which is currently age 55. Provided you have reached NMPA, as soon as we receive a transfer we will be able to pay a withdrawal, there is no waiting period.

The normal minimum pension age is the earliest age that you can usually access your pension savings and is set by the government. This is currently age 55, however this is rising to age 57 from 6 April 2028. Therefore, if you’re born on or after 6 April 1973, you will have a minimum pension age of 57 so will not be able to take any benefits until they reach that age. This applies to all pensions in the UK, although the State Pension has different rules.

Yes, we can pay the tax free lump sum with the rest left invested in your plan which you can access later on at any time. You don’t have to take your full 25% all in one go, you can take this in stages so you can benefit from any growth in your pension.

MyExpatSIPP allows you to take withdrawals using flexi-access drawdown rules. This means you have complete control and flexibility over how you withdraw the money from your pension.

You can find out more about the withdrawal options here.

Once we receive the transfer from your previous provider, we can usually pay withdrawals within 5 working days.

No, we can pay your withdrawals to a bank account anywhere in the world. Payments can only be made to an account held in your name, either solely or jointly.